s corp tax calculator nyc

Smaller businesses with less net income will only have to pay 65. 50 Receipts exceeding 100000 but not.

How Are Dividends Taxed 2022 Dividend Tax Rates The Motley Fool

All other corporations 15.

. Another way that corporations can be taxed is directly on their business capital less certain liabilities. Information on this page relates to a tax year that began on or after January 1 2021 and before January 1 2022. Estimated Local Business tax.

S Corp Tax Calculator - S Corp vs LLC Savings. Not more than 100000. Photo by Dimitry Anikin.

Electing S corp status allows LLC owners to be taxed as employees of the business. Annual cost of administering a payroll. For example if you have a.

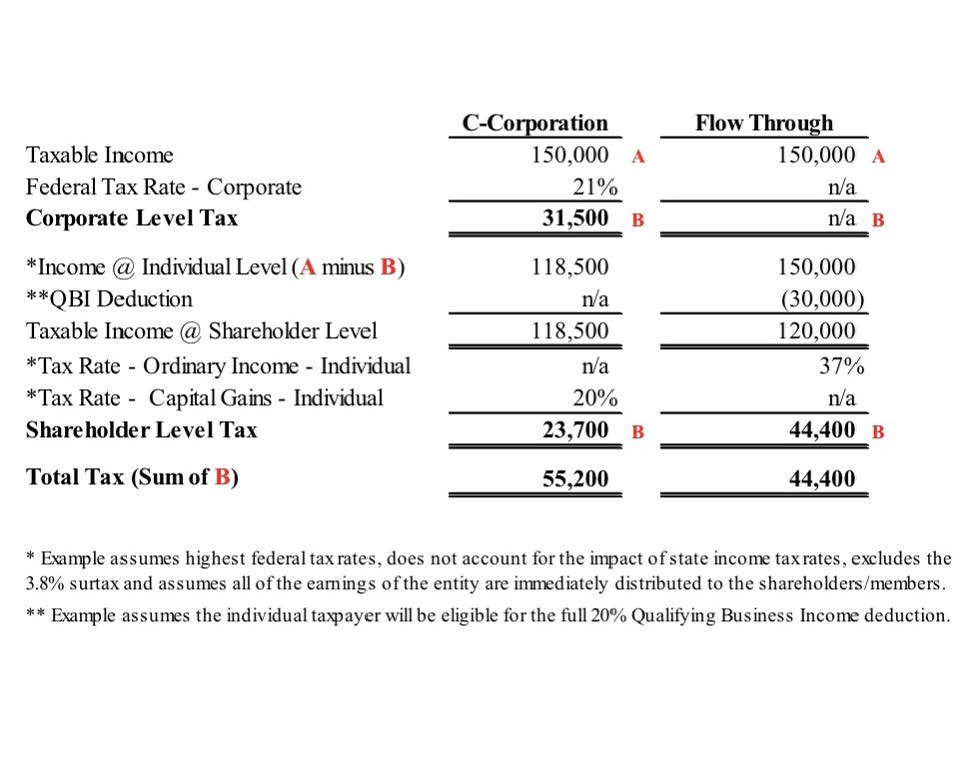

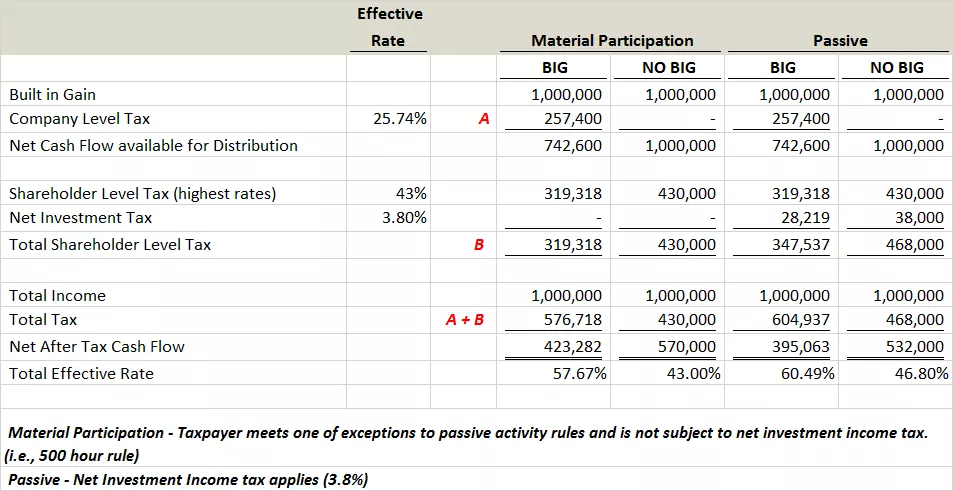

Rate in Tax Year 2015 and thereafter. For example in New York City an S-corp would be subject to the citys 885 business tax on top of state and federal taxes. See S corporations - tax years beginning before January 1 2015 for S corporation information for years prior to corporate tax reform.

25 Receipts not exceeding 100000. If your business is incorporated in New York State or does. This could potentially increase the S-corp tax bill significantly and.

This allows owners to pay less in self. See TSB-M-15 7C 6I for additional. If your company is taxed at a high level try our S Corp tax savings calculator.

Annual state LLC S-Corp registration fees. Total first year cost of S-Corp. Check each option youd like to calculate for.

Partnership Sole Proprietorship LLC. How s corporations help save money. What percent of equity do you own.

New York Estate Tax. Effective for tax years beginning on or after January 1 2015 the general corporation tax GCT only applies to subchapter S corporations and qualified subchapter S subsidiaries under the. The s corp tax calculator.

For S-corporations the FDM tax is based on the corporations New York State receipts and is as follows. Our small business tax calculator has a separate line item for meals and entertainment because the IRS only allows companies to deduct 50 of those expenses. The portion of total business capital directly.

And Is There A Prime. Cooperative housing corporations 04. However one major difference from c corporations is that the new york city s corporation tax rate is a flat 885as opposed to a range of 65 to 885.

Bike Snob NYC So What Year Are We On. S corp tax calculator nyc thursday february 10 2022 edit.

Free Tax Resources Tools And Tips To Simplify Tax Season Lili Banking

S Corp Election Self Employment S Corporation Taxes Wcg Cpas

/taxes_in_new_york_for_small_businesses_the_basics-5bfc3575c9e77c005145c81b.jpg)

Taxes In New York For Small Business The Basics

Significant Cuts To The Corporate Tax Rate Is It More Beneficial To Be A C Corporation Now Bernard Robinson Company

Tax Treatment For C Corporations And S Corporations Under The Tax Cuts And Jobs Act Smith And Howard Cpa

Kruze Consulting New York City Tax Services For Startups

Should You Choose S Corp Tax Status For Your Llc Smartasset

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

S Corp Tax Savings Calculator Newway Accounting

![]()

New York Paycheck Calculator 2022 With Income Tax Brackets Investomatica

S Corp Vs Llc Which Is Best For Your Business Smartasset

S Corporation Tax Calculator Spreadsheet When How The S Corp Can Save Taxes Vs Sole Proprietor Youtube

S Corp Tax Calculator Llc Vs C Corp Vs S Corp

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

New York Income Tax Calculator Smartasset